Investment Process & Strategy

Investment Objective

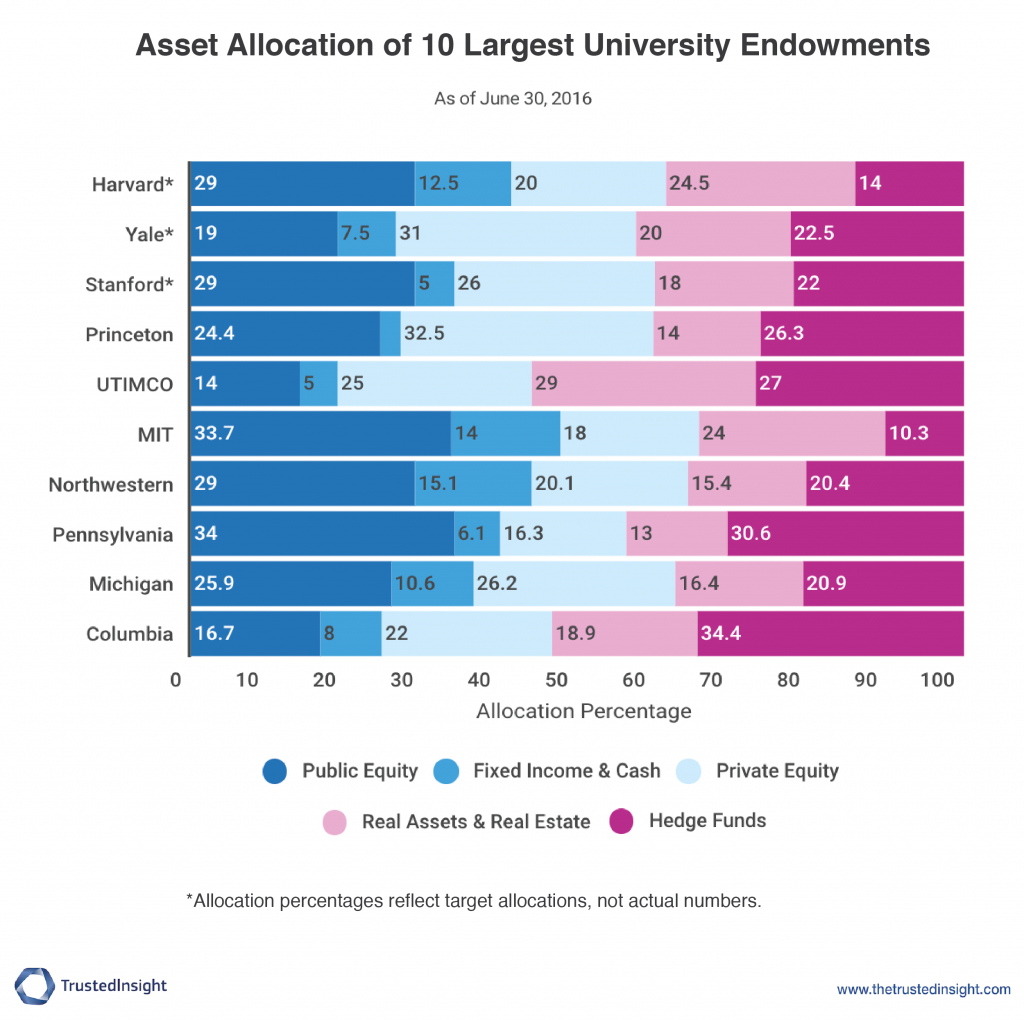

The Tamil Endowment Fund seeks long-term capital appreciation and income by employing investment strategies and asset allocation techniques followed by traditional endowment funds.

Investment Strategy

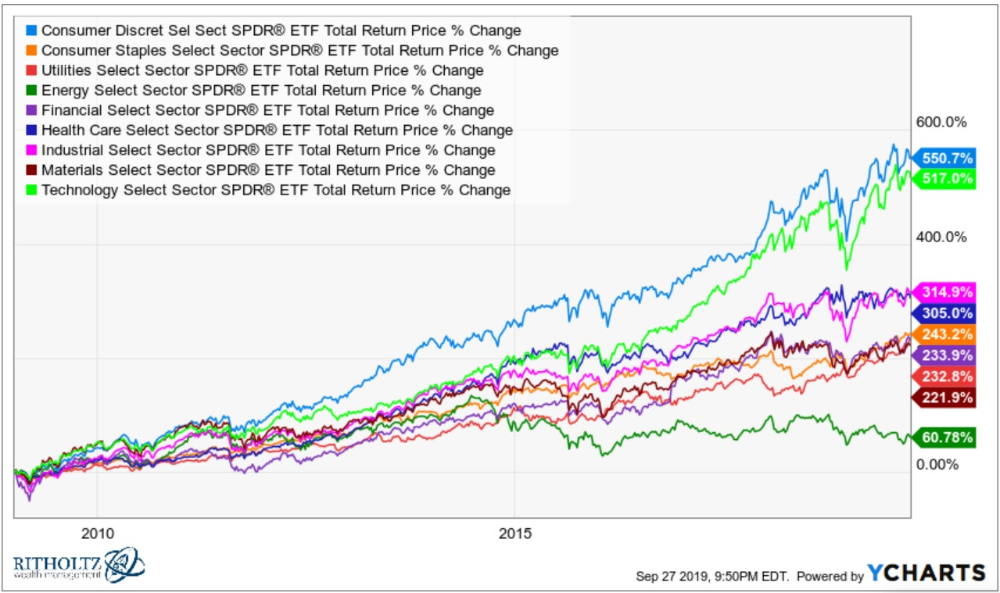

Our investing style seeks to increase total portfolio return while maintaining an acceptable level of risk through diversifying into performance-oriented assets. Our allocation is intended to be across a range of asset classes and geographies. Endowments are able to take advantage of these different asset classes because they feature a long-term investment time horizon with low liquidity needs.

We invest our endowment through selecting funds, rather than selecting companies or assets directly.

Investment Process

Asset Allocation

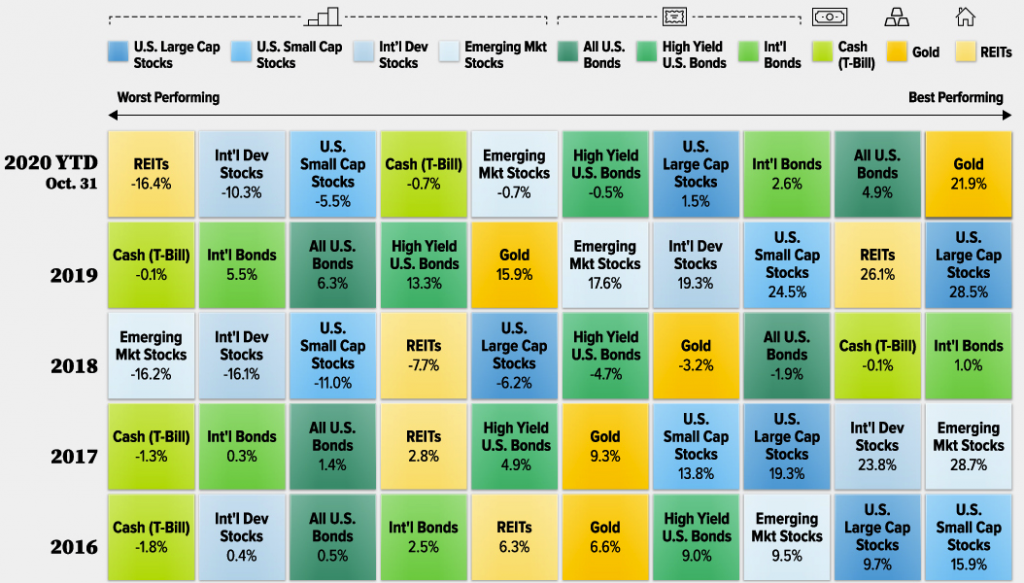

- One of the main factors that leads to your overall returns is establishing an appropriate asset mix of stocks, bonds, cash, and real estate

- Establish and adhere to a base policy mix – a proportional combination of assets based on expected rates of return for each asset class.

- Assess risk tolerance and investment time-frame when setting targets and then rebalance your portfolio every now and then.

- For example, if stocks have historically returned 10% per year and bonds have returned 5% per year, a mix of 50% stocks and 50% bonds would be expected to return 7.5% per year.

Tactical Asset Allocation

- Over the long run, a strategic asset allocation strategy may seem relatively rigid.

- Occasionally it may be necessary to engage in short-term, tactical deviations from the mix to capitalise on unusual or exceptional investment opportunities.

- This flexibility adds a market-timing component to the portfolio, allowing participation in economic conditions more favourable for one asset class than for others.

Fund Selection

We select funds in combination to produce a portfolio that exhibit the following properties:

- Broad Diversification: Investments are made in numerous investment categories ranging from traditional equities and bonds to alternative investments such as real estate and private equity.

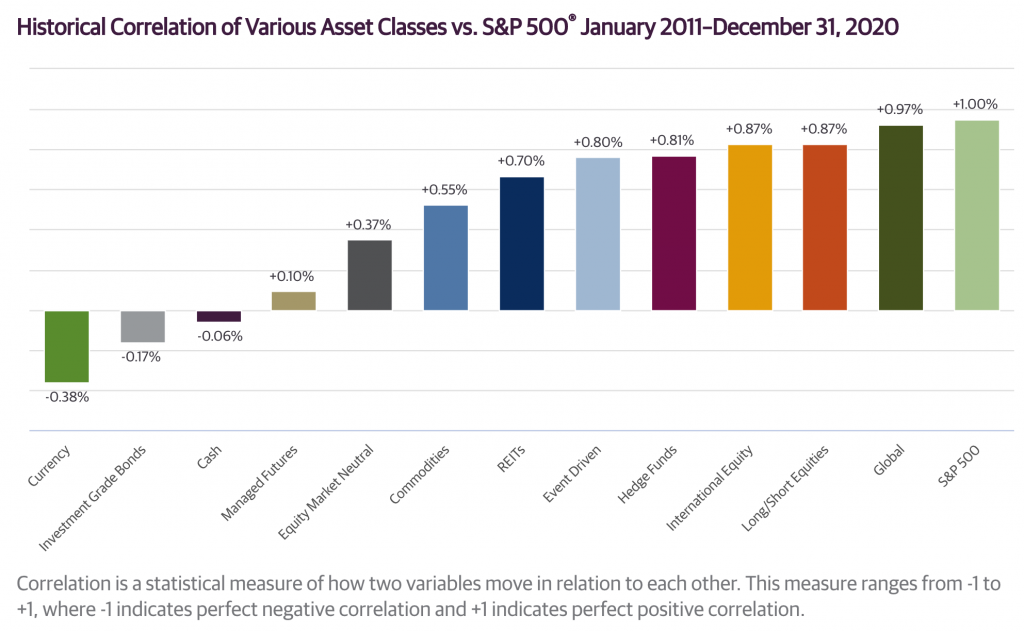

- Reduced Correlation: Limited or low correlation between investments is targeted to reduce overall portfolio volatility.

- Alternative Investments: Large percentages of the portfolio are devoted to holdings other than stocks and bonds.

- Inflation Protection: Investments in real or hard assets such as real estate are sought because they can offer inflation protection and income as well as capital appreciation potential.

Investment Selection

- Each fund investment will have a written proposal outlining its strengths and weaknesses, the investment team, fees, performance, ESG credentials

- Upon investment committee approval, capital is allocated and deployed

Portfolio Monitoring

- Every quarter portfolio positions are reviewed and reported to the investment committee

- The portfolio is reviewed against our Strategic asset allocation – identifying any deviations

- Any material deviations in investment performance and composition are analysed and reviewed for any further investment actions